Centurion Financial Group

Experts In Wealth Creation, Superannuation, Investment Strategy,

Retirement Planning and Financial Planning Melbourne.

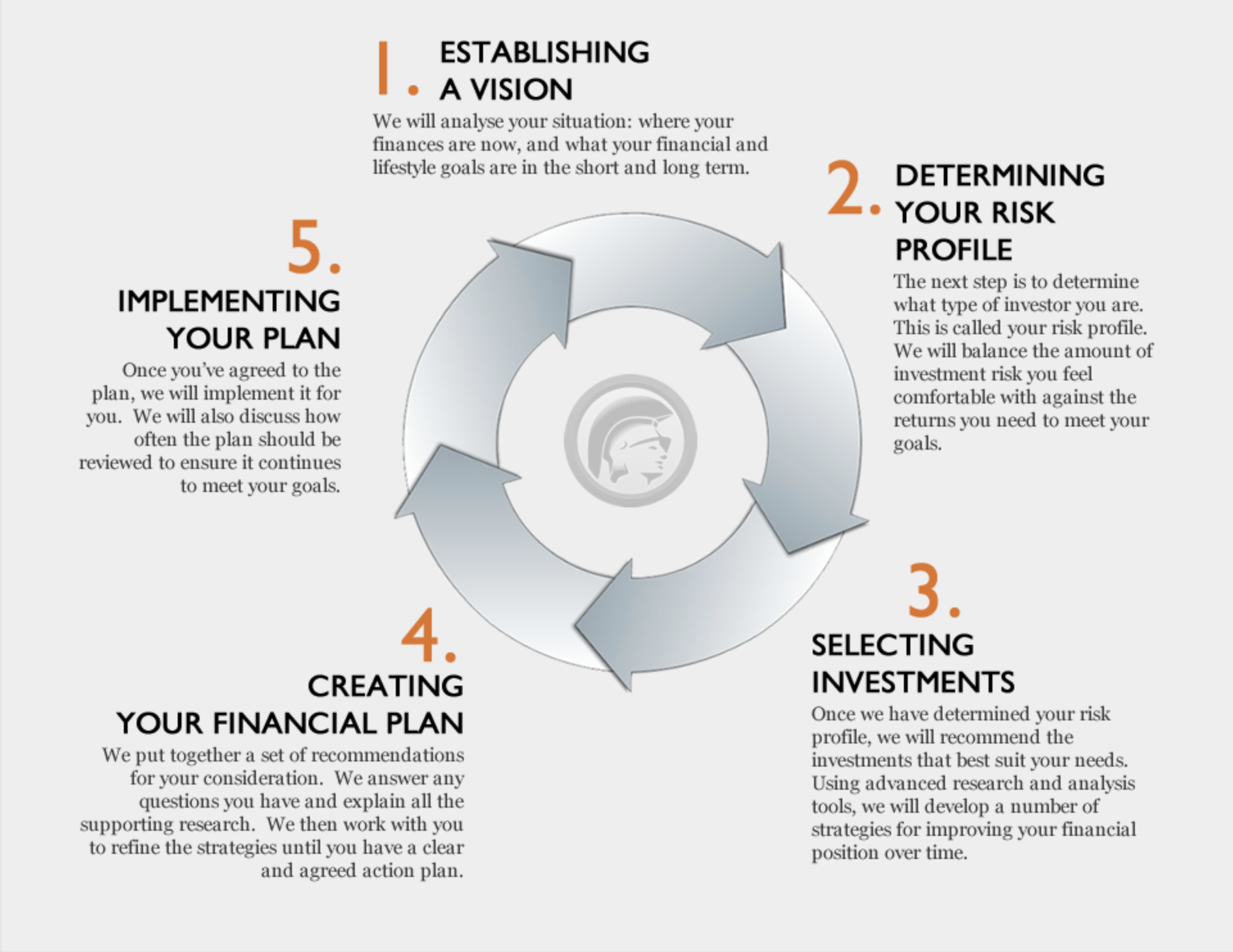

We are a Melbourne based financial planning firm that provides professional wealth advice, tailored specifically to your needs, at all stages of life. Our financial advisors provide strategic advice to guide you through life’s important financial decisions, enabling you to reach your personal financial goals. Our financial advice services will evaluate your current circumstances and what you hope to achieve in the future. By comparing all the available options and removing any conflicts of interest, we will provide you with the best financial advice possible. Many planning practices operate under the major banks, meaning they are likely to offer a limited ‘in-house’ product that may not be in your best interests. In order to maximise the most of your portfolio, investment and financial plan get in touch with us today and see how we can set you on the pathway to financial freedom.

Our Range Of Financial Services.

Need a personalised solution?

Let us help you understand your financial future with a custom tailored financial plan, investment strategy & superannuation plan that will not only grow your revenue, but save you money.

How Can You Maximise Your Finances In The Future?

Get a no obligation cost consult to see if we are a good fit for you & your goals.

It is never too late to take control of your finances and financial plans. It is important to get professional financial advice in order to ensure you make the most of your wages savings and savings for years to come.

How Can You Maximise Your Finances In The Future?

Get in touch with us for a FREE 15 minute consultation.

It is never too late to take control of your finances and financial plans. It is important to get professional financial advice in order to ensure you make the most of your wages savings and savings for years to come.

How Can You Maximise Your Finances In The Future?

Get in touch with us for a FREE 15 minute consultation.

It is never too late to take control of your finances and financial plans. It is important to get professional financial advice in order to ensure you make the most of your wages savings and savings for years to come.